Overview

Shale oil and gas production and prices have dominated the news as they both profoundly affect the global economy and life, as we know it on this planet.

Congress is poised to vote for approval of the long awaited XL pipeline that will bring Canadian crude to southern refineries. Plastics and other industries that produce oil byproducts are taking advantage of the windfall produced by falling crude prices and warehouses are burgeoning with inventory. The price at the pump has consumers ecstatic. For the first time in nearly a decade, they have felt relief from soaring gas prices, leaving them a few extra dollars to spend on other necessities.

But what is happening with this North American oil boom? How long will it last? Does it have a down side?

As all good things, it will not last forever. And yes, it can and does have a down side. Read the opinions of the experts and pundits in the business world to get the picture from their lofty positions in luxurious skyscraper offices.

For an overall realistic view, read the Boston Globe report by Evan Horowitz that addresses the effects of oil prices on all areas of the economy around the globe. How today’s prices could effect the future might surprise you.

House Passes Bill to Speed Natural Gas Pipelines

An article by Cristina Marcos in the Hill reports that earlier this week, Congress passed 253-169, the bill allowing automatic approval of natural gas pipelines if federal agencies don’t act within defined timeframes. Under the measure, the Federal Energy Regulatory Commission (FERC) would be ordered to approve or deny a pipeline application within 12 months.

Full Story

U.S. Shale Production Hurting OPEC as well as Canadians

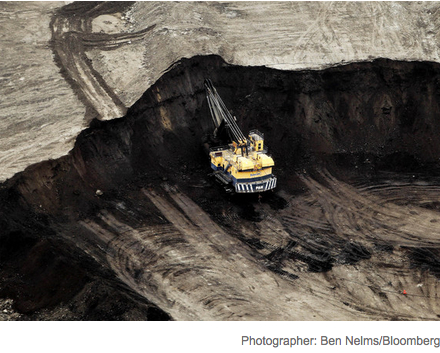

A Bloomber article by Robert Tuttle and Dan Murtaugh reports that OPEC isn’t the only victim of the growth in the U.S. shale oil. The increase in Texas and North Dakota shale production is also hurting Canadian producers that are upgrading heavy oil sands into light crude that fetches more from refiners. “The U.S. refining market is being flooded with the light crude, and they wouldn’t necessarily want our light stuff,” said Dinara Millington, vice president for research at the Canadian Energy Research Institute.

Full Story

“U.S. Shale Industry May Shrink by 30%,” Ross Perot, Jr.

According to a CNN article by Alanna Petroff the son of the legendary oil magnate Henry Ross Perot Sr. said the recent U.S. shale gas boom was “unsustainable,” and now it’s time for a bust.

Perot predicts that crude oil prices could slip below $40 per barrel. That would shut down 20-30% of the U.S. shale industry as the falling price makes production to expensive.

“Crude prices are trading around $47 per barrel, but were trading over $100 in June” Perot said.

His comments come as a growing number of oil companies announce cuts to jobs, production and investment.

Baker Hughes (BHI) revealed plans to slash 7,000 jobs and cut capital spending by 20%.

Full Story

As IMF Cuts Forecast, Oil Continues to Fall; Iran Hints at $25 Oil

A Reuters report by Barani Krishnan said that oil fell as much as 5 percent after the International Monetary Fund cut its 2015 global economic forecast and key producer Iran hinted prices could drop to $25 a barrel without supportive OPEC action.

Traders said that Genscape, an analytics firm monitoring U.S. oil stocks reported a 2.6 million-barrel build last week in Cushing, Oklanhoma, the delivery point for the U.S. crude futures contract, adding to the market’s bearish sentiment.

The trade group American Petroleum Institute and the government’s Energy Information Administration will release issue their data tally a day late, delayed by a holiday on Monday.

Full Story

Speaker: Shale Oil, Gas Has Transformed the Plastics Industry

Senior staff reporter for Plastics News, Jim Johnson, wrote in an article that Phillip Karig is not saying that the shale gas boom is over.

Nonetheless, the managing director of Mathelin Ba Associates LLC, a plastics industry consulting firm, wants people to know that today’s truths are not necessarily the same as tomorrow’s.

Karig remembered life in the plastics world a decade ago to prove his point that things can, and do, change.

“Think back 10 years ago. Common knowledge back then was U.S. energy production had peaked. There was nowhere for oil and gas prices except up. Imported resins were going to flood the U.S. Plants were going to shut down. And no one in their right mind was going to invest anything in new polymer production capacity,” Karig said.

Full Story

Declining Oil Prices: A Windfall for Plastic Packaging

A Zacks Equity Research article said “Falling oil prices” are ruling the headlines nowadays, a paradigm shift from oil prices hovering around $100 per barrel for the past few years supported by surging global demand, particularly in China.

While falling oil prices have created mayhem for industries like energy, the plastic packaging industry enjoys a strategic position in the marketplace to capitalize on the situation. Deteriorating oil prices will not only provide a cost tailwind but will also boost demand due to the increasing disposable income at the consumer level.

Full Story

What’s Really Happening to Oil Prices?

Boston Globe staff writer Evan Horowitz reports with an impartial, realistic hand concerning the state of the oil market. The article covers the ecstatic cheers from consumers as oil dipped under $50 and gave the entire economy a booster shot, leaving everyday people with a few leisure dollars to squander as they wish.

However, Horowitz was quick to present the dark side as well. Falling prices are having a profoundly negative effect on the largest business of all, the oil industry itself. And the repercussions are being felt around the globe. The oil industry in the big oil-rich countries like the United States cannot function without high prices. Additionally, cheap oil reduces any incentive to go green, and will surely slow the transition to renewable energy.

Read the Full Story