Global Petrochemical Prices Rise by 5.4% in February

The ICIS Petrochemical index, which tracks the average change in global petrochemical prices over time, increased by 5.4% month on month in February. Several factors can be attributed to the increase in prices across the board, but stronger feedstock costs seemed to be driving the increase. Of all the markets, the northeast Asian chemical market […]

“Quiet Q1 ” | Episode 087, February 2023

TheChemCo · Episode 087: February 2023 – “Quiet Q1” “The View from Jamestown” Chemical Podcast Hosted by The Chemical Company Episode 087 | February 2023 – A not-so-exciting start to Q1 – Delta between Gas/Oil and Derivative Pricing: PGP, Benzene and more – Minimal Impact from Chinese New Year – Positivity out of Latin America – Travel Season: SOCMA […]

Economic Stressors Leading to Chemical Industry Overstock

Inflation and rising cost of living has forced consumers to cut back on spending, leading to severe overstock in inventories. Because of this, the global chemical industry has been cutting operating costs. The energy crisis, which has contributed greatly to the complications surrounding the cost of living, has created a demand shock which has left […]

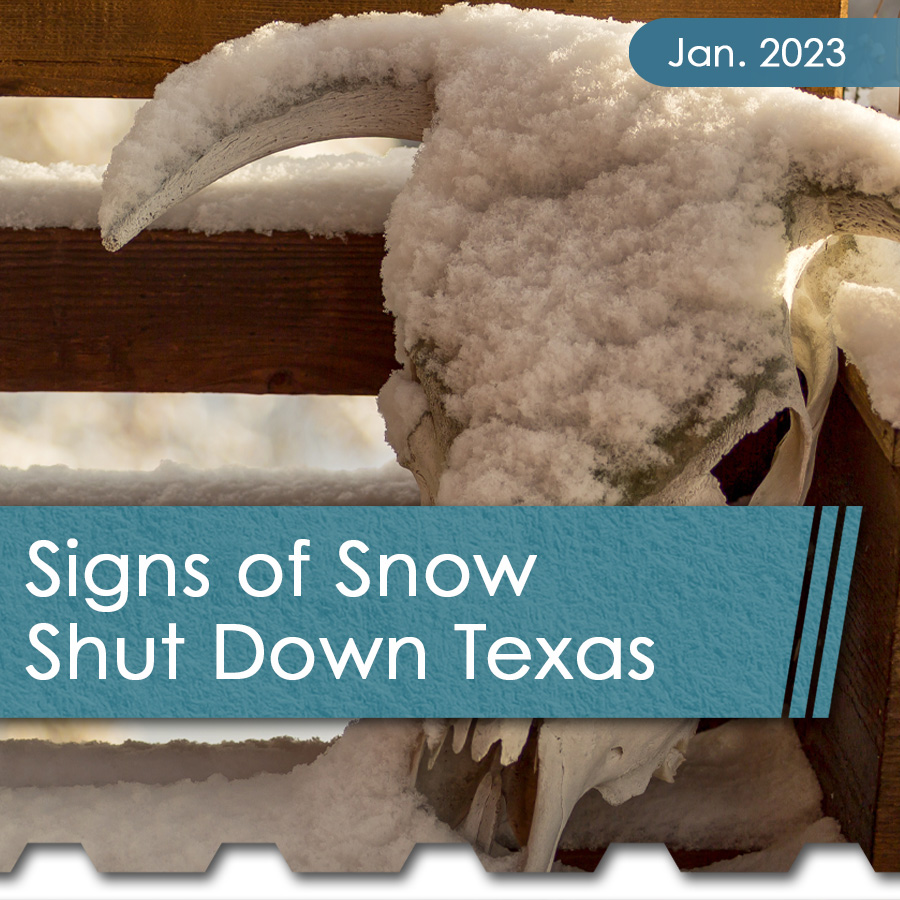

Texas Plants Shut Down Ahead of Freeze

Plants in Texas shut down operations recently in preparation for a cold front that caused temperatures to reach below freezing. Cold weather disruptions, that seemingly started within the last year, are detrimental to Gulf Coast plants as many of them are not equipped to handle long periods of freezing temperatures. Extremely frigid temperatures can […]

Brenntag and Univar Hint at Merger Plans

In November of 2022, chemical industry giant Brenntag said it planned to double its annual spending on mergers and acquisitions, specifically noting the goal of consolidating the industry and improving technical capabilities. Now, Brenntag is reportedly in talks with Univar, the world’s third-largest chemical distributor, regarding a merger. This deal would combine two of the […]